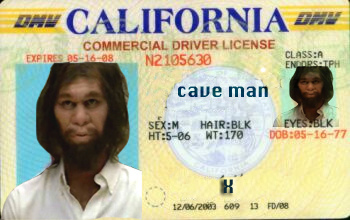

Stop Identity Theft

By now, every adult should know that identity theft is the fastest growing crime in America.

This means that the requirement for sufficient and robust fraud protection has grown. Identity protection has become something essential just like auto and medical insurance. Make no mistake we are under an unrelenting onslaught of identity theft.

ID theft, medical Id theft and credit fraud continue because it is effortless to do and, the prosecution rate is extremely low, making this crime fashionable. There is no magical way to protect you from all sorts of ID Theft but one of the most important keys is know-how and usual common sense. ID Theft affects over 9 million Americans alone each year. It’s your worst nightmare, someone stealing your identity could have you end up having to go to court for a crime you didn’t commit. Each year, the federal trade commission compiles a list of statistics on ID Theft. The biggest trouble with id theft statistics is that situations can go for years and years prior to being detected. ID Theft statistics is calculated by the federal trade commission that 1 out of ten people will be a victim.

Placing an initial fraud warning is part of the ID Theft monitoring process, this will restrict the fraudster from opening a credit account. It will help you by monitoring credit reports and carefully monitoring your credit report is critical to rapidly. As the situations of ID Theft increase so does the amount of credit monitoring plans and id theft insurance companies. When evaluating any ID Theft service, the primary functions you should watch for are fraud warning and scam monitoring.

In order to evade becoming a victim of ID Theft there are a number of important decisions you can and should take. There are lots of options when it comes to internet monitoring. The most efficient way to fight ID Theft is to verify your billing statements regularly as well as monitor your credit report as stated above. Credit report monitoring can provide an early alert if somebody has committed identity theft on your personal information.

In order to evade becoming a victim of ID Theft there are a number of important decisions you can and should take. There are lots of options when it comes to internet monitoring. The most efficient way to fight ID Theft is to verify your billing statements regularly as well as monitor your credit report as stated above. Credit report monitoring can provide an early alert if somebody has committed identity theft on your personal information.

Ask Your ID Theft and Home Alarm Question HERE!

Learn to Set Fraud Alerts on YOUR Credit Report

Credit Card Fraud Alert

ID Theft Monitoring to Protect Your Finances

Identity Theft Laws

Medical ID Theft Can Prevent You From Being Treated

Back to Home Alarms-to-Alert-You